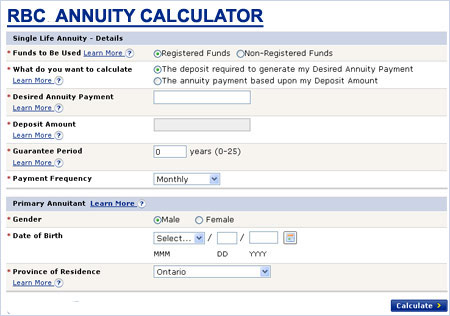

20 Year Certain And Life Annuity Calculator

In the biannual payment example above the total number of payments would be 40 twice a year times 20 years.

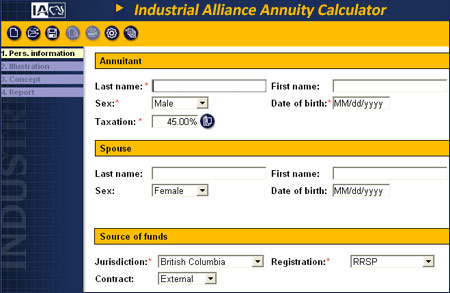

20 year certain and life annuity calculator. Variable annuities can provide a higher rate of return but they have more risk. Life annuity incomes are guaranteed for life. But you can add a specific guarantee period that ensures the annuity income continues for a period of time even if you die. Money is paid upfront but the income payments you receive are delayed for a period of 2 40 years.

This is a stream of payments that occur in the. Use the following formula to determine the periodic payment of the annuity. Most annuity purchasers use guarantee periods to guard against the risk of dying soon after purchasing. Annuity a fixed sum of money paid to someone typically each year and usually for the rest of their life.

A term annuity is a financial product that guarantees payment for a specific period of time such as 5 10 or 20. Variable annuities invest in riskier assets. The set expiration date differentiates the annuity certain from a life annuity. You can estimate the monthly payments from an annuity if you know the price of the annuity the fixed interest rate the frequency of your payments monthly quarterly or yearly and the number of years the annuity will provide you with income.

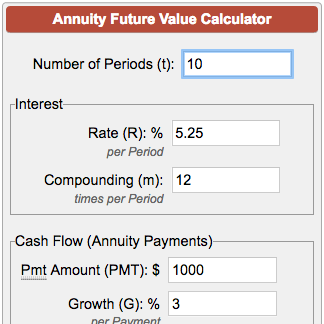

Multiply the number of payments per year by 20 the number of years in the annuity to calculate the total number of payments in the life of the annuity. Understanding the annuity certain. It is possible for your monthly payment to fall. With this calculator you can find several things.

The payment that would deplete the fund in a. In most cases it only applies to the beginning 5 to 9 years of the life of an annuity but some plans may be subject to a surrender charge for as long as 15 to 20 years. Present value of annuity calculator terms definitions. An annuity running over 20 years with a starting principal of 250 000 00 and growth rate of 8 would pay approximately 2 091 10 per month.

The tool assumes a 10 year guarantee period applies to the life annuity. For example a 20 year fixed annuity with a principal amount of 100 000 and a 2 percent annual. How much does a 100 000 annuity pay per month. Deferred income annuities or dias for short provide lifetime income starting 2 40 years from now.

For example mutual funds that hold equities. An annuity is an investment that provides a series of payments in exchange for an initial lump sum.