20 Year Mortgage Rates Quicken Loans

At quicken loans 20 year mortgages represented about 6 percent of all loans in 2013 and are equally popular with move up buyers and refinancing homeowners says bob walters chief economist for quicken loans in detroit.

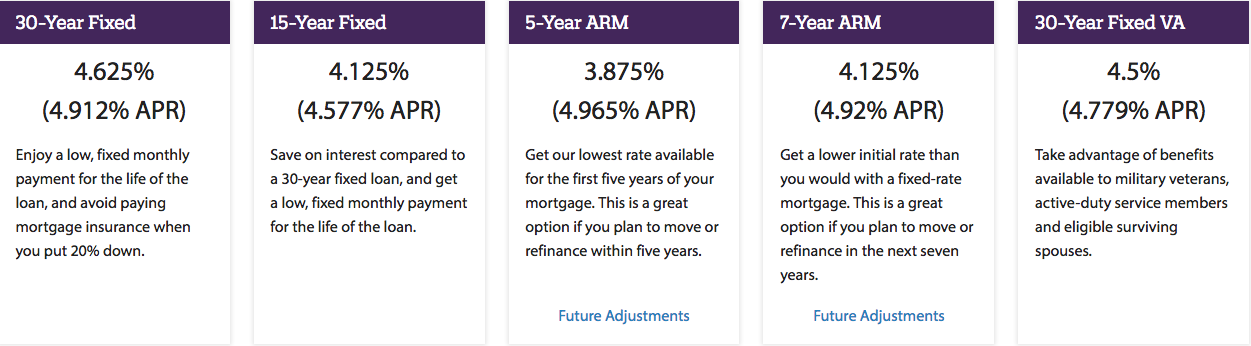

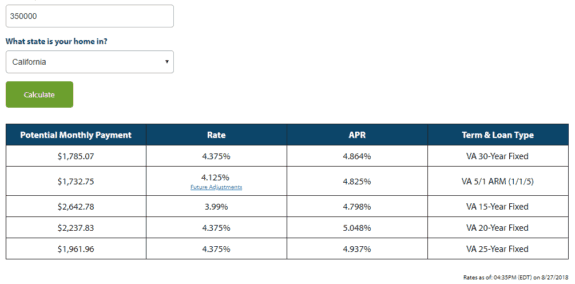

20 year mortgage rates quicken loans. On friday october 02 2020 according to bankrate s latest survey of the nation s largest mortgage lenders the average 20 year fixed refinance rate is 3 130 with an apr of 3 330. The 20 year mortgage is often overlooked by borrowers and lenders but this unusual loan. Arms are a great option if you expect to sell your house or refinance before the initial fixed rate period ends. Who yourgage loans are best for people who want a flexible loan length and an interest rate that never changes over the entire life of the loan.

Refinancing to a loan with a lower rate means you could get a lower payment as long as you don t shorten the length of your mortgage term. A 20 year fixed rate mortgage is a home loan that maintains the same interest rate and monthly principal and interest payment over a 20 year loan period. Many of our clients opt for 30 or 15 year fixed rate loans. One point is equal to one percent of your loan amount.

Payment does not include taxes and insurance. The actual payment amount will be greater. He says few first time buyers opt for a 20 year mortgage rates because the payments are higher than a 30 year home loan. Determining which term is better for you will depend on your.

A popular arm is the 5 year arm which is a 30 year mortgage with an initial. The payment on a 200 000 15 year fixed rate loan at 2 75 3 197 apr is 1 357 25 for the cost of 2 00 point s due at closing and a loan to value ltv of 74 91. Stop paying for private mortgage insurance pmi if you put less than 20 down on your original home loan chances are you re paying for pmi. A 20 year fixed rate mortgage is a 20 year amortization where your loan is repaid fully over that period.

The actual payment amount will be greater. A quicken mortgage yourgage offers fixed rates with the option to pick any term from 8 to 29 years. Adjustable rate mortgages arms offer lower rates than some other loan types. If your home has increased in value and or you have enough.

One point is equal to one percent of your loan amount. Payment does not include taxes and insurance.